Market operations and trend correlation analysis of assets 692502874, 3029989192, 604182548, 219428700, 695213081, and 120025315 reveal intricate relationships that warrant careful examination. Correlation coefficients indicate how closely these assets move in relation to one another, influenced by various economic factors. This interdependency can shape investment strategies significantly. Understanding these dynamics may unlock opportunities, yet the implications of such correlations present challenges that require further exploration.

Overview of Selected Assets

In examining the landscape of selected assets, it becomes evident that market dynamics are influenced by a complex interplay of economic indicators and investor sentiment.

Asset performance is often susceptible to market volatility, which can distort perceived value and risk. Understanding these relationships allows investors to navigate potential pitfalls, enhancing their capacity to make informed decisions amidst fluctuating market conditions.

Analyzing Correlation Trends

While market fluctuations are often unpredictable, analyzing correlation trends among various assets provides crucial insights into their interdependencies and collective behavior.

By calculating correlation coefficients, analysts can evaluate how closely asset prices move in relation to one another.

This trend evaluation reveals patterns that may inform investment strategies, aiding investors in navigating market volatility and making informed decisions that align with their financial goals.

Market Behavior Insights

Market behavior insights provide valuable perspectives on how economic indicators, investor sentiment, and external events influence asset prices.

Analyzing market sentiment through the lens of behavioral finance reveals patterns of irrationality and herd behavior. Understanding these dynamics enables informed decision-making, allowing investors to navigate volatility and capitalize on trends with greater autonomy.

Such insights foster a deeper comprehension of the market’s intricate interplay.

Strategic Implications for Investors

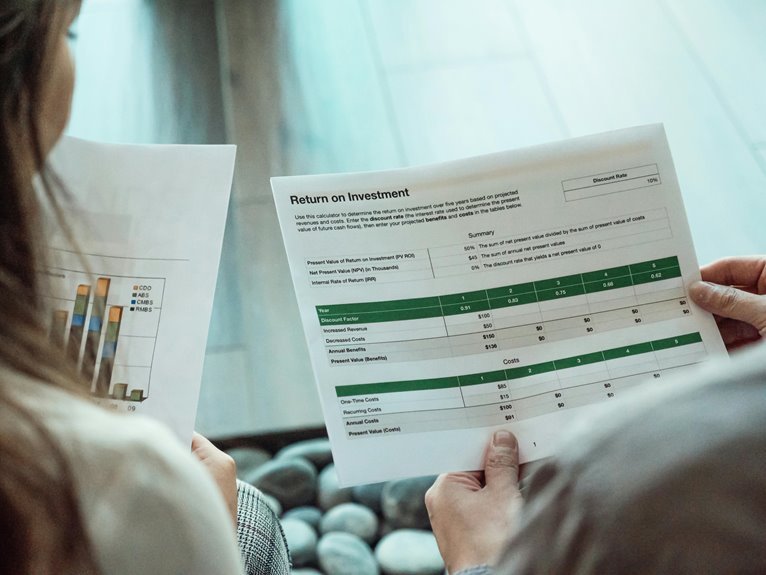

The insights gained from market behavior can significantly inform strategic implications for investors.

Effective risk management becomes paramount when developing investment strategies that align with identified trends. By understanding market dynamics, investors can optimize their portfolios, enhancing potential returns while mitigating exposure to volatility.

This analytical approach fosters informed decision-making, empowering investors to navigate complex markets with greater confidence and freedom.

Conclusion

In conclusion, the correlation analysis of assets 692502874, 3029989192, 604182548, 219428700, 695213081, and 120025315 underscores the intertwined nature of market dynamics. By recognizing these relationships, investors can anticipate price movements, align their strategies with market sentiment, and mitigate risks effectively. Thus, understanding these correlations not only aids in optimizing portfolios but also empowers investors to navigate volatility with confidence, ultimately enhancing their potential for sustained financial success.